Breaking News: Reversal in Nate Chastain Case--2d Circuit Tosses NFT "Insider Trading" Conviction

Breaking News: Reversal in Nate Chastain Case--2d Circuit Tosses NFT "Insider Trading" Conviction In a stunning reversal, the U.S. Court of Appeals for the Second Circuit has vacated Nate Chastain’s conviction for wire fraud and money laundering, dealing a serious blow to the DOJ’s high-profile effort to apply legacy fraud statutes to digital assets. The case—long labeled “the first NFT insider trading prosecution”—has been sent back to the Southern District of New York for further proceedings. Here’s what happened—and why it matters.

Background: Who Is Nate Chastain? The DOJ charged him with wire fraud and money laundering. The media called it “NFT insider trading.”When I was in NYC, I attended Chastain’s criminal trial. After the jury returned a guilty verdict, Chastain, the former OpenSea product head, was sentneced to serve e three months in prison after being convicted of using inside information to front-run featured NFT listings. The goverment charged that Chastain chose which NFTs would be spotlighted on OpenSea’s homepage—a selection that often triggered a price surge. The government further alleged that he secretly bought those NFTs ahead of the listing and sold them shortly after for a profit, netting around $57,000. Chastain appealed his guilty verdict and sentence. And now, the Second Circuit has sided with him.

The Court’s Reasoning: Information ≠ Property The Second Circuit’s ruling strikes at the heart of the DOJ’s case. The wire fraud statute criminalizes schemes to deprive someone of “money or property.” The government argued that Chastain stole OpenSea’s “property”—its confidential information about which NFTs would be featured. But the appeals court disagreed. In a sweeping opinion, the court ruled that: “Confidential business information does not qualify as ‘property’ under the wire fraud statute unless it has commercial value to the company.” Opinion at 12. In other words, just because OpenSea wanted to keep the information private doesn’t mean it had the kind of property interest the law protects. And here’s the kicker: the court found the featured NFT info didn’t materially impact OpenSea’s business. It wasn't bought, sold, monetized, or even treated with meaningful secrecy internally. That made it too “ethereal” to be the basis for a federal fraud charge. Opinion at 24. Worse for the DOJ, the jury was instructed that it could convict Chastain based simply on conduct that was “unethical” or contrary to “honesty and fair play.” That, the court ruled, was improper: “The instructions invited the jury to return a guilty verdict if it found that Chastain had acted unethically—even if he did not invade a traditional property interest of the company.” That instruction, the court concluded, tainted the verdict beyond repair.

Implications for Crypto and Beyond This reversal is a major setback for federal prosecutors seeking to fit emerging digital behaviors into traditional fraud frameworks.

What Happens Next? The case now returns to the lower court. While retrial is technically possible, the DOJ may decline to proceed—especially after this strong rebuke. Chastain has not served his sentence, and unless the government appeals to the Supreme Court (a long shot), the case may quietly end.

STRENGTHENING AMERICAN LEADERSHIP IN DIGITAL FINANCIAL TECHNOLOGY: A Turning Point for Crypto in America

The recent report issued by the President’s Working Group on Digital Asset Markets is a landmark moment for crypto policy in the United States. Clear, well-reasoned, and packed with practical legal and regulatory proposals, the report lays out a bold new path that embraces innovation while defending individual rights. Below are some of the key takeaways that stood out. TL;DR — I’m more bullish than ever on the future of crypto in America.

🔓 Freedom to Build, Freedom to Transact

“Protecting and promoting the ability of individual citizens and private-sector entities alike to access and use for lawful purposes open public blockchain networks without persecution, including the ability to develop and deploy software, to participate in mining and validating, to transact with other persons without unlawful censorship, and to maintain self-custody of digital assets.” (p. 1)

The report opens with a clear affirmation of rights on public blockchains, emphasizing lawful access, use, and development as fundamental liberties.

🛑 Operation Choke Point 2.0: A Cautionary Tale

“The Biden Administration’s approach to crypto was marked by regulatory overreach that countered the American tradition of embracing new technologies. Operation Choke Point 2.0 saw regulators push banks to cut off lawful crypto businesses, effectively debanking the industry.” (p. 5)

The report is unsparing in its criticism of the previous administration’s tactics, characterizing them as an aggressive regulatory overreach that chilled innovation.

🧱 Protecting the Right to Innovate

“American citizens and businesses should be able to own digital assets and use blockchain technologies for lawful purposes without fear of prosecution. Likewise, American entrepreneurs and software developers should have the liberty, and regulatory certainty, to upgrade all sectors of our economy using these technologies.” (p. 6)

🏛️ Reforming the BSA for the Blockchain Era

“Congress should codify principles regarding how control over an asset impacts Bank Secrecy Act (BSA) obligations, particularly for money transmitters. A software provider that does not maintain total independent control over value should not be considered as engaged in money transmission for purposes of the BSA.” (p. 6)

💵 Stablecoins as Dollar Power Tools

“U.S. dollar-backed stablecoins represent the next wave of innovation in payments, and policymakers should encourage their adoption to advance U.S. dollar dominance in the digital age. All agencies to which Congress delegated responsibilities under the GENIUS Act should faithfully and expeditiously execute those responsibilities.” (p. 7)

🌐 Make America the Global Hub for Digital Assets

“To ensure this innovation... takes place in the United States, American markets for digital assets need to become the deepest and most liquid in the world. Just as the United States is the premier destination for capital markets activity... it is imperative that the United States lead by establishing clear rules for digital asset markets.” (p. 43)

🌍 International Leadership Matters

“The United States has a window of opportunity to shape the way these [digital asset] frameworks intersect and interact... The Working Group advises the United States to engage and lead internationally to achieve these objectives.” (p. 59)

🏦 Regulatory Roadblocks Must Go

“Although many in the banking industry supported the growth and development of the crypto ecosystem, regulatory leadership set up roadblocks... requests from these banks were almost universally met with resistance... As a result, the vast majority of banks simply stopped trying.” (p. 63)

⚖️ Fair and Neutral Regulation

“The Banking Agencies should ensure that existing and new best practices or guidance on risk management and bank engagement are technology-neutral and that expectations regarding offering banking services do not discriminate against lawful businesses solely due to their industry.” (p. 75)

🛰️ Stablecoins and Law Enforcement

“Although stablecoins have been used in illicit finance, traditional means of money laundering and terrorist financing remain more prevalent... stablecoin issuers can coordinate with law enforcement to freeze and seize assets to counter illicit use.” (p. 91)

🚫 No to CBDCs, Yes to Privacy

“Discourage, oppose, and prohibit... any agency from undertaking any action to establish, issue, or promote any CBDCs in the United States... Support legislation prohibiting the adoption of any CBDCs... including the Anti-CBDC Surveillance State Act.” (p. 95)

🔍 Most Digital Asset Activity is Legitimate

“Despite increasing over the last decade, the prevalence of money laundering and terrorist financing via digital assets remains well below... fiat currency... certain industry estimates indicate that the vast majority of digital asset activity is legitimate.” (p. 101)

🔧 Tailor AML to DeFi

“Congress should consider codifying language expressing which portions, if any, of the DeFi ecosystem should have AML/CFT obligations and the kinds of obligations actors should have...” (p. 106)

🔄 IRS-BSA Harmonization Needed

“Once digital asset transactions are required to be reported on Form 8300, this discrepancy [between the IRS and BSA] may create substantial industry confusion...” (p. 110)

🛡️ Privacy Is a Right

“The Working Group supports civil liberties protections... enabling privacy is also critical to enabling the increased use of digital assets for payments...” (p. 111)

🧠 Zero Knowledge, Full Compliance

“Zero Knowledge Proofs... can enable users to confirm that their identity has been verified... without revealing underlying personal information... digital identity solutions offer innovative capabilities to protect sensitive information...” (p. 112)

📘 New Tax Rules for New Tech

“Legislation should be enacted that treats digital assets as a new class of assets subject to modified versions of tax rules applicable to securities or commodities...” (p. 129)

💳 Stablecoin Tax Clarity

“Legislation should be enacted that would characterize payment stablecoins for federal income tax purposes... Characterization as debt seems most appropriate...” (p. 131)

💸 Don’t Tax the Dust

“...frequent small rewards... airdrops... may be illiquid and therefore hard to value... the IRS should issue administrative guidance that addresses de minimis receipts of digital assets.” (p. 134)

📑 E-Consent and 1099-DA Simplification

“Treasury and the IRS should propose regulations that provide brokers... a less burdensome method of obtaining consent... to furnish Form 1099-DA electronically.” (p. 137)

🔗 Track Cost Basis Across Exchanges

“Treasury and the IRS should consider proposing regulations requiring basis information to be reported when digital assets are transferred between centralized digital asset exchanges.” (p. 139)

🇺🇸 A Blueprint for the Future

“Overall, I think the report is well written, reasoned and very comprehensive in its coverage of both the challenges digital assets face under current legal frameworks and the proposed solutions to solve these challenges. Well done.”

This report doesn’t just chart a course—it lights the way. Crypto’s future in America is looking brighter than ever.

How Fully Regulated Stablecoins Under the GENIUS Act Can Help Family Offices Move Money Faster Than Traditional Banks Can

Introduction

The recent passage of the GENIUS Act of 2025 marks a turning point for stablecoins in the United States. Signed into law on June 18, 2025, this act establishes the first comprehensive federal framework for “payment stablecoins”. It requires that U.S. dollar-backed stablecoins be fully reserved 1:1 with safe assets, issuers register with bank regulators, and robust audits/AML controls be in place. In short, stablecoins are becoming fully regulated digital cash equivalents, offering new confidence to institutional users. This clarity is exactly what many family offices have been waiting.

Family offices – private wealth management firms for ultra-high-net-worth families – could greatly benefit from these regulated stablecoins. By transacting in fully collateralized, USD-pegged digital currency, they stand to save on hefty bank fees and gain 24/7 access to investment deals.

The GENIUS Act: A New Era for Fully-Regulated Stablecoins

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act ushers in strict standards that transform stablecoins into a highly trusted form of digital money. Key features of the Act include:

Permissible Issuers: Only regulated entities (banks or licensed companies) can issue stablecoins in the U.S., subject to federal or certified state oversight. After a transition period, it becomes illegal to offer unregulated stablecoins, ensuring all widely used stablecoins meet safety standards.

1:1 Reserve Backing: Every stablecoin must be fully backed by high-quality, liquid assets – e.g. cash, insured bank deposits, or short-term U.S. Treasuries. Issuers must maintain at least 100% reserves and publicly disclose monthly reserve reports, including the composition of assets and total coins issued.. This guarantees that stablecoins are redeemable one-for-one for dollars at any time, eliminating the risk of “runs” or lost convertibility.

Priority and Safeguards: The law builds in protections like giving stablecoin holders first-priority claim on reserve assets if an issuer becomes insolvent. Issuers cannot rehypothecate or misuse the reserve and custodians of reserve assets must segregate them from other funds. These measures make fully regulated stablecoins exceptionally safe compared to earlier stablecoin models.

Regulatory Compliance: Stablecoin issuers are now treated as financial institutions under the Bank Secrecy Act, meaning they must implement rigorous AML/KYC programs. The Act also explicitly clarifies that stablecoins issued under this regime are not securities or commodities– removing legal uncertainty that previously concerned traditional investors.

Importantly, federal regulators are now in a rulemaking phase: within 6 months of enactment, they must propose detailed regulations to implement the law. The full framework is expected to take effect in 2026 (or sooner if rules are finalized). This means family offices have a short window to prepare for and capitalize on this new regulated stablecoin environment. Early adopters can gain an edge in efficiency and deal-making agility.

Why Family Offices Should Care About Stablecoins

Fully regulated stablecoins offer concrete benefits that align with family offices’ needs for efficient, cost-effective, and secure financial operations. Here’s why family offices should pay attention:

Instant, 24/7 Liquidity for Deals: Family offices can deploy capital at any hour without banking cut-off times. A stablecoin is essentially a digitized dollar that “can move at the speed of the internet, 24/7, with near-zero transaction costs and with settlement times measured in seconds rather than days.” This means if a time-sensitive investment opportunity arises on a weekend or after banking hours, a family office can still move funds immediately. Real-time blockchain settlement eliminates the 2-3 day wait of ACH or the cut-off times of wire transfers. The result is 24/7 access to deals and the ability to act quickly on investments or fund calls, giving family offices greater agility.

Significant Cost Savings on Transfers: Using stablecoins can dramatically cut transaction costs. Traditional payment methods (bank wires, international transfers, custodial fees, etc.) often carry high fees that eat into investment returns. For example, wire transfers or credit card payments incur fees and currency conversion charges that can reach 3–5% in some cases. In contrast, stablecoin transactions cost only a fraction of traditional methods – often just pennies or a few dollars – regardless of transaction size. They also settle nearly instantly, avoiding prolonged float and eliminating intermediary fees across correspondent banks. A recent analysis highlights that stablecoins “settle in seconds, often for pennies,” whereas SWIFT international wires take days and cost ~4–6% in fees. For family offices doing large transactions (seven-figure investments, global asset purchases, etc.), the savings in bank fees and forex spreads can be substantial. Stablecoins essentially make moving money as simple and cheap as sending an email.

Improved Treasury Management and Yield Opportunities: Many family offices are cash-heavy, maintaining liquid reserves for investments or expenses. Keeping cash idle in bank accounts yields minimal returns and can be slow to deploy. By holding portions of their cash in a regulated USD stablecoin (backed by actual dollars/treasuries), a family office can enjoy real-time liquidity while potentially integrating with platforms that offer yield (e.g. lending out stablecoins or investing in tokenized T-bills). In fact, tokenized short-term Treasury funds (a stablecoin-like concept) are already being used by family offices to reduce friction in treasury operations and unlock real-time settlement. With stablecoins, operational liquidity is enhanced – moving money between portfolio entities or into investments becomes seamless. And since GENIUS Act stablecoins are not treated as securities, family offices can use them freely for transactions without complex regulatory hurdles.

Security and Risk Mitigation: Fully regulated stablecoins minimize many risks that previously kept conservative investors away. Under the new law, a compliant stablecoin is fully backed and transparent, so the risk of collapse (like the TerraUSD incident) is mitigated by law. Each stablecoin coin is a claim on a dollar (or equivalent asset) held in reserve, and holders even have priority claim to those reserves if an issuer fails. While these stablecoins are not FDIC-insured deposits, the strict regulations effectively make them as safe as holding cash in a trust – with the added benefit that fraud and compliance checks are built into the issuance and redemption process. Additionally, blockchain transactions are highly traceable and secure; every movement of funds is recorded on an immutable ledger, reducing counterparty risk and enhancing auditability. For family offices worried about transparency and control, it’s worth noting that monthly reserve reports and audits are mandated for issuers., and any misrepresentation (like falsely claiming a stablecoin is “insured”) carries steep penalties. In short, fully-regulated stablecoins provide trust through regulation – combining the stability of the U.S. dollar with the technological security of blockchain.

Global Reach and New Opportunities: Family offices increasingly have an international footprint – investments in multiple countries, global real estate, cross-border philanthropic projects, etc. Stablecoins facilitate instant, direct transactions worldwide with just an internet connection and a wallet, “bypassing the delays, paperwork, and intermediaries” of traditional cross-border payments. This can simplify funding an overseas venture or distributing funds to family members abroad. Moreover, embracing digital assets positions family offices for the future of finance. They gain a window into broader tokenization trends – for example, easier participation in fractional ownership deals or blockchain-native investment opportunities. Early adopters can even invest in the infrastructure (fintech startups, DeFi platforms) that underpins this ecosystem, turning a compliance upgrade into a strategic advantage.

Stop moving money at the speed of banks, and start moving money at the speed of the internet with fully regulated stablecoins under the GENIUS Act.

Unlocking the Future of Finance: What Fully Regulated Stablecoins Under the GENIUS Act Mean for Consumers, Businesses, and Family Offices

Introduction: From Gray Area to Green Light

The Guiding and Establishing National Innovation for U.S. Stablecoins Act — the GENIUS Act — represents a watershed moment in U.S. financial regulation. For the first time, we have a comprehensive federal legal framework for payment stablecoins, removing the ambiguity that has long shadowed digital dollar assets. As a lawyer embedded in the crypto ecosystem, I've tracked this legislation from the moment it was introduced to its passage in mid-2025. What’s unfolding now is not simply a compliance mandate — it’s the opening of a new financial frontier for consumers, businesses, and family offices alike.

What the GENIUS Act Does

At its core, the GENIUS Act establishes a licensing, compliance, and supervisory regime for USD-backed stablecoinsthat are intended for use as a medium of exchange. To legally issue or operate with such stablecoins in the U.S. after the Act's implementation deadline, entities must be federally or state-approved "permitted payment stablecoin issuers" (PPSIs). Key mandates include:

1:1 Reserve Requirements: Fully backed by cash, short-term U.S. Treasuries, or equivalent high-quality liquid assets.

No Interest Payments: Stablecoins cannot accrue interest or yield by default, to avoid being classified as securities or deposits.

Redemption Clarity: Holders must be able to redeem their stablecoins promptly in fiat USD, with published policies and disclosures.

Strict AML/KYC Compliance: Stablecoin issuers are treated as financial institutions under the Bank Secrecy Act.

Regulator Supervision: PPSIs will be subject to regular audits, public disclosures, and federal or state oversight depending on scale.

Timeline: When Does the GENIUS Act Take Effect?

The GENIUS Act has a dual-trigger timeline for implementation:

Full Effect: The Act becomes fully enforceable on the earlier of:

18 months after enactment (i.e., by December 2026), or

120 days after final implementing regulations are issued (projected for late 2026).

Grace Period for Non-Compliant Stablecoins:

For up to 3 years post-enactment, digital asset service providers (e.g., exchanges, custodians) may temporarily support non-compliant stablecoins, but must fully transition to regulated PPSIs by mid-2028.

Why This Matters: Use Cases and Opportunities

1. For Consumers: Financial Safety Meets Digital Efficiency

With GENIUS-compliant stablecoins:

Trust is codified: Consumers no longer need to “trust but verify” that their stablecoins are backed 1:1 — the law mandates it.

No speculative risk: By banning interest payments and rehypothecation of reserves, the Act ensures that stablecoins are a cash-equivalent, not a quasi-investment product.

Faster and cheaper payments: Transactions can occur 24/7, globally, with near-zero fees — a vast improvement over ACH or wire rails.

Action Step: Consumers should seek out wallets and apps that support PPSIs and educate themselves on the difference between regulated vs. unregulated stablecoins.

2. For Businesses: Programmable Payments and Treasury Innovation

Businesses stand to gain the most from GENIUS Act-aligned stablecoins in the following ways:

Instant B2B and B2C settlement: Imagine paying vendors, freelancers, or even issuing refunds instantly, even on weekends.

Automated compliance: With integrated AML/KYC logic and API-based payments, businesses can automate flows while staying compliant.

Treasury optimization: While stablecoins don’t bear interest, companies can still deploy idle capital in yield-bearing products outside the stablecoin itself.

Action Step: CFOs and COOs should begin upgrading their payment infrastructure to support stablecoins like USDC (expected to be PPSI-approved), and assess whether they fall under money transmitter rules if acting as intermediaries.

3. For Family Offices: A Digital Dollar Strategy with Legal Certainty

Family offices — traditionally conservative on tech adoption — now have a secure gateway into digital finance:

Cross-border capital deployment: Stablecoins can be used to move funds globally, 24/7, without correspondent bank delays or FX fees.

Liquidity during non-banking hours: Participation in venture deals or fund calls over weekends or holidays becomes viable.

Redemption protections: Under the Act, even in insolvency, stablecoin holders have priority rights to reserve assets.

Action Step: Family offices should implement a GENIUS-compliant stablecoin infrastructure — including wallet custody agreements, transaction monitoring, and KYC policies — tailored to private wealth and cross-border use cases.

How to Prepare: Action Items by Sector

StakeholderKey ActionsConsumersUse only wallets and exchanges that support GENIUS-compliant stablecoins.BusinessesEngage legal counsel to assess money transmitter obligations. Integrate regulated stablecoin APIs.Family OfficesImplement custody and compliance infrastructure. Start with a turnkey solution (e.g., USDC on Sui).

Strategic Counsel: This Isn’t Just Compliance — It’s a Competitive Edge

As a crypto-native lawyer, I believe the GENIUS Act is not just a regulatory clampdown — it's a greenlight for innovation with guardrails. The regulated stablecoin is becoming the digital equivalent of a certified check — legally robust, instantly transferable, and backed by enforceable rights.

The winners in this new financial terrain will be those who prepare early. Businesses and family offices that integrate GENIUS-compliant rails will be able to deploy capital faster, reduce settlement risk, and operate globally — all while staying within the bounds of U.S. law.

Final Word

The GENIUS Act marks the formal entrance of stablecoins into the core of American financial law. Whether you’re a fintech startup, a global family office, or a consumer with a digital wallet, this law creates clarity, security, and opportunity. But make no mistake: the window to prepare is closing. Those who wait until 2027 or 2028 may find themselves scrambling to catch up with the new rules of the digital dollar.

If you want to understand how this law applies to your specific use case — from setting up a compliant stablecoin system to navigating cross-border regulatory hurdles — reach out for a private strategy briefing. The future of finance is programmable, permissioned, and now — federally regulated.

Why Stablecoins Under the GENIUS Act Are the Smartest Move for Family Offices

Stop moving money at the speed of banks and unlock faster capital deployment, lower costs, and 24/7 liquidity under the GENIUS Act.

The GENIUS Act of 2025 isn’t just a win for the digital asset sector—it’s a turning point for family offices looking to modernize global financial operations. With bipartisan support and full federal legal clarity, fully compliant stablecoins under the GENIUS Act give family offices the advantage of moving “digital dollars” at the speed of the internet.

If your office routinely moves capital internationally, responds to market windows in real time, or is seeking a more efficient treasury architecture, stablecoins under the GENIUS Act represent a material edge. This article walks through why this new law matters and how to take advantage of it immediately.

What the GENIUS Act Changes for Family Offices

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) was signed into law on July 18, 2025. It defines a clear, enforceable framework for USD-backed stablecoins used as payment instruments. That includes:

1:1 reserve backing (cash and T-bills only)

No interest-bearing returns (so they aren’t classified as securities)

Full issuer licensing through the OCC or equivalent state regulators

Required public audits and redemption rights

Legal clarity: these assets are not securities, commodities, or banking deposits

This means that family offices will soon be able to use digital dollars—like USDC—with the assurance of regulatory compliance, operational safety, and full redemption rights.

Five Reasons Family Offices Are Deploying Stablecoins Right Now

Faster Deal Funding

A cross-border venture deal doesn’t need to wait for a Monday wire cutoff. Stablecoins settle in seconds, 24/7. If your family office funds an opportunity in Singapore or Brazil, stablecoins can deploy capital on a weekend or public holiday—without delay or intermediaries.Lower Fees and Cost Efficiency

Traditional international wires often incur 3–5% in FX and wire charges. With stablecoins like USDC, that cost drops to under 0.3%, depending on the blockchain used. For example, using USDC can reduce a $1 million transfer fee from ~$30,000 to a few dollars.Global USD Access Without a U.S. Bank

In markets like Argentina, Vietnam, or the UAE, stablecoins offer a way to hold USD value legally and compliantly—without the friction of local bank hurdles. Your counterparties, asset managers, or vendors abroad can receive funds in USDC instantly and convert them as needed.Treasury Control and Liquidity

Stablecoins can be held in institutional-grade wallets (e.g., Fireblocks, Anchorage Digital) with multi-signature approvals, whitelisted addresses, and audit trails. You can enforce internal controls while gaining real-time treasury agility.Regulatory Peace of Mind

With GENIUS Act compliance baked in, assets like USDC will finally be treated as “cash equivalents” under accounting rules. Once the GENIUS Act takes effact, customer holdings will get priority in bankruptcy proceedings, be, subject to public attestation, and legally redeemable for USD. In practice, this means less counterparty risk than many traditional banks or FX desks.

Use Cases Across the Office

With GENIUS-compliant stablecoins, Family Offices can:

Settle capital calls in real time

Receive distributions from global private equity funds

Fund overseas operating partners without delays

Make philanthropic grants abroad (particularly in Latin America)

Maintain USD exposure in volatile jurisdictions

If your family office sends more than $5 million internationally each year, adopting a stablecoin strategy could generate six figures in annual cost savings while dramatically improving speed and transparency.

What About Risk?

The GENIUS Act includes safeguards rarely seen in crypto regulation:

No algorithmic stablecoins allowed

Strict issuer vetting and licensing

Monthly audits and CEO/CFO certifications

AML/KYC mandates for all stablecoin holders

Full asset segregation and legal protection in bankruptcy

Circle’s USDC, for example, is already integrated with the OCC and is expected to be among the first fully GENIUS-certified stablecoins. Platforms like Coinbase Custody, Copper, and Fireblocks support secure custody of USDC under bank-grade protocols.

How to Get Started

For family offices new to digital assets, stablecoins offer a gateway that avoids volatility, speculation, or risky protocols. A typical stablecoin setup includes:

Opening a Circle Account to mint/redeem USDC via wire or ACH

Choosing a blockchain

Setting up institutional custody with compliance workflows

Establishing a governance policy and transaction approval protocol

Running a pilot (e.g., $10,000 test transfer abroad)

Scaling with 24/7 internal workflows

Importantly, if your family office only uses stablecoins for its own transactions, no special license is required. The family office may be treated as an end-user—not a money transmitter under the GENIUS Act.

The Bottom Line

Stablecoins are no longer “emerging tech.” Under the GENIUS Act, they are now a regulated tool for 21st-century finance—approved by Congress, signed into law by President Trump, backed 1:1, and integrated with U.S. banking oversight.

For forward-looking family offices, this is an opportunity to unlock real operational alpha: faster funding, cheaper transfers, USD stability abroad, and audit-grade transparency—all with regulatory peace of mind.

Crypto Week Delivers: GENIUS Act Ushers in the Era of Regulated Stablecoins

This week marks a turning point for digital assets in America. After years of uncertainty, the U.S. House of Representatives passed the GENIUS Act, and it's now headed to President Trump’s desk for signature. With the Clarity Act gaining traction and a ban on a U.S. CBDC also passing the House, it’s fair to say: Crypto Week delivered.

But today, we zero in on the GENIUS Act—a once-in-a-generation breakthrough that sets the stage for fully regulated, 1:1 USD-backed stablecoins. Here's why it matters—and why it’s the “Trojan horse” that will finally onboard the masses to blockchain tech.

💡 Why the GENIUS Act Was Needed

Stablecoins like Tether and Circle’s USDC have existed for years, but they lacked a unified, federally regulated framework. Tether operates offshore, with opaque audits. Circle is state-licensed (New York), but not fully integrated under national oversight. Neither gave regulators or the public complete confidence.

Meanwhile, algorithmic failures like Terra/LUNA only worsened trust.

To truly scale stablecoin adoption—to use them in business, payroll, commerce, and global transactions—we needed:

Mandatory 1:1 reserve backing in USD or Treasuries

Audited transparency

Consumer protections

Federal regulatory clarity

That’s what the GENIUS Act delivers.

🧠 What the GENIUS Act Does

Requires stablecoin issuers to be licensed (federal or state-certified)

Mandates 1:1 USD-equivalent reserves (cash, short-term Treasuries)

Prohibits paying interest or yield to avoid volatility and systemic risk

Imposes strict AML/KYC compliance and independent monthly audits

Gives consumers priority rights in bankruptcy (ahead of other creditors)

Blocks the U.S. government from launching a central bank digital currency (CBDC)

⚙️ Why This Changes Everything

Stablecoins are the next great payment rail. And unlike wires, checks, and credit cards:

They settle instantly, 24/7/365

They’re cheap, trackable, and irreversible

They remove credit card fees and bank wire delays

They work globally without FX conversions

This is what money looks like at the speed of the Internet.

🏦 What This Means for Banks, Businesses, and Family Offices

Banks must adapt or risk obsolescence. Consumers will ask: Why are you charging me to move money like it’s 1985?

Businesses can now accept stablecoin payments instantly, with no swipe fees

Family offices can invest globally, move liquidity 24/7, and avoid FX and banking bottlenecks

Consumers can transact with confidence, using USD-backed tokens they can redeem at any time

The question will shift from “Why use stablecoins?” to “Why are you still using checks and wires?”

🧭 What Happens Next

Once signed today, Treasury and regulators will begin rulemaking

Expect a 6–12 month window before new stablecoin licenses are issued

Existing issuers (like Circle and Tether) will need to retool and apply

Banks and fintechs will have a clear path to issue their own stablecoins

This is Stablecoin Summer. Everyone from fintech startups to retail giants like Amazon will begin exploring issuance and integration.

🇺🇸 Why This Is Good for America

Every new regulated stablecoin = more U.S. Treasury demand

Treasuries backing stablecoins will boost the dollar’s dominance

Private stablecoin growth may lower interest rates by replacing foreign buyers of Treasuries

It strengthens U.S. innovation while preserving consumer protections

No more waiting on other countries. America is ready to lead in digital finance.

🧠 Final Thoughts: The Trojan Horse

We’re not onboarding the next billion people to crypto by pitching DeFi or NFTs.

We’re doing it by making money move like email.

Once stablecoins become familiar—safe, easy, and cheap—the jump to holding ETH or BTC won’t feel so foreign. This is the on-ramp, and it’s now law.

🚨 It’s time to get ready:

• Banks must modernize

• Issuers must apply

• Consumers must learn

• Family offices must explore

Those who prepare now will lead the future of money.

The age of regulated digital dollars has arrived. Are you ready?

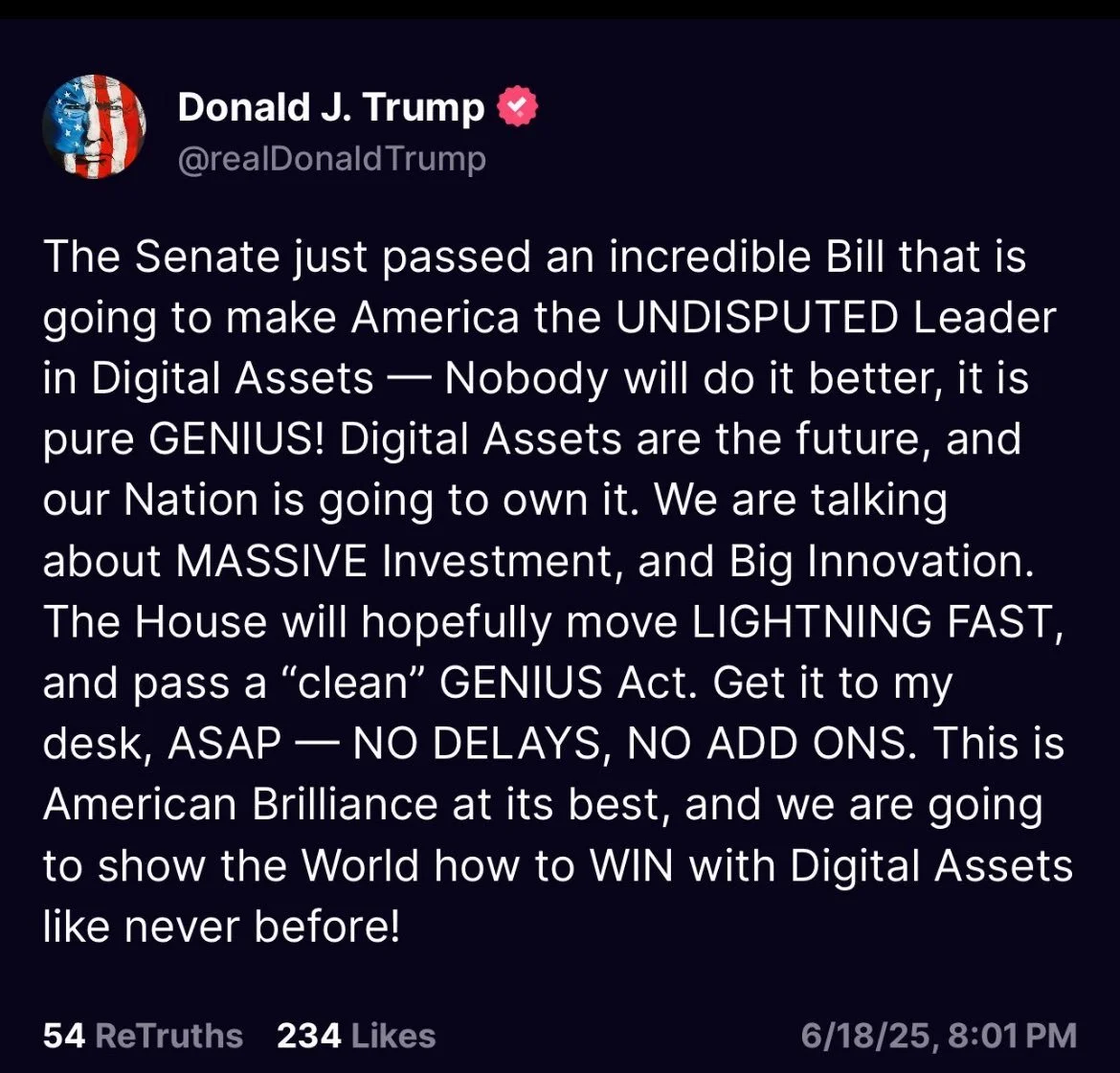

Trump Pushes GENIUS Act to Center Stage

In a late evening post on June 18th, former President Donald J. Trump delivered a forceful call to action: pass the GENIUS Act in the House without delays or amendments. Celebrating the bill’s Senate approval, Trump hailed it as “an incredible Bill” that would establish the U.S. as the “UNDISPUTED Leader in Digital Assets.”

“Nobody will do it better, it is pure GENIUS,” Trump wrote, urging Congress to deliver a clean bill to his desk “ASAP — NO DELAYS, NO ADD ONS.”

His words echo and amplify growing sentiment among pro-crypto legislators that the GENIUS Act represents not just regulatory reform but a strategic national investment in digital finance.

🏛️ What’s in Play: GENIUS Act Recap

The GENIUS Act, short for “Guiding Emerging National Innovations for Uniform Standards”, is a bipartisan initiative aimed at:

Establishing a federal framework for stablecoin issuance

Clarifying roles of the Federal Reserve and state-chartered institutions

Encouraging private sector innovation while protecting consumers

Preventing fragmentation by offering clear preemption language

🏃 Next Steps: Lightning Fast or Legislative Quagmire?

With Trump's public nudge, House Republicans are expected to prioritize a floor vote, possibly within days. But not all House members are aligned. Key Democrats are seeking addenda related to systemic risk and FDIC protections, while some progressives remain skeptical of language perceived to enable large financial institutions to dominate the stablecoin market.

Important to note that FDIC coverage is essential for traditional bank deposits due to the inherent risks of the fractional reserve model, where only a portion of funds are held in reserve, exposing depositors to potential losses in a crisis. In contrast, fully regulated stablecoins backed 1:1 by U.S. Treasuries do not require FDIC insurance, as they are not reliant on rehypothecation or lending and maintain full asset backing at all times.

Nonetheless, Trump’s “NO ADD ONS” demand raises the political stakes. His framing casts any modifications as delays to American leadership in digital assets, putting pressure on House members to move swiftly—or face public scrutiny from a highly vocal base.

🧩 Advisory Takeaway: Implications for Legal Strategy

If passed cleanly, the GENIUS Act would deliver:

Regulatory clarity for stablecoin issuers

A credible framework for state-federal coordination

Predictable pathways for compliance—key for institutional onboarding

It’s time to consider how this evolving regulatory posture impacts banks and business and start a positioning, product design, and jurisdictional strategy. The message is clear: Washington is taking stablecoins seriously—and fast.

📢 Watch This Space

With high-level political backing and fast-tracked momentum, stablecoin regulation is no longer a theoretical debate—it’s becoming real law, real soon. We will continue monitoring House developments and industry responses. #StablecoinSummer

Senate Passes GENIUS Act—A Watershed Moment for Stablecoins

On June 17, 2025, the U.S. Senate overwhelmingly approved the GENIUS Act in a 68–30 bipartisan vote—marking the first major crypto legislation to clear the Senate this session and establishing the groundwork for stablecoin

Why it matters

Regulatory clarity. The bill mandates that stablecoins be 1:1 backed by reserves (cash or Treasuries), enforce regular audits (notably for issuers over $50 billion), and makes compliant tokens legally distinct from securites.

Consumer & financial security. It enhances protections—priority for holders in bankruptcies, stricter anti-money laundering and national-security measures.

🔍 Behind the Bipartisan Vote

Bridging the divide A mix of 18 Democrats, including Senators like Gillibrand, Alsobrooks, and Gallego, joined Republicans after key amendments were added—bolstering ethics safeguards and consumer.

Lingering criticism Critics like Senators Elizabeth Warren and Jeff Merkley warned it could enable corruption, especially given the exemptions that leave the President and his family’s crypto interests (e.g. USD1 via World Liberty Financial). Warren argued the bill “turbocharges Trump’s corruption” by potentially allowing the president to “regulate his own financial product”

📌 What Comes Next: The Road to the House

House floor ahead. The bill now shifts to the Republican-controlled House, where it may be merged with the STABLE Act or modified—prompting another round of negotiations .

Priority timeline. The Senate hopes to pass both chambers before the August recess—including President Trump’s push to enact it pre-recess.

📈 Industry & Market Impact

Circle (USDC), Paxos, Ripple, and Tether (USDT) stand to benefit from a clear U.S. regulatory framework, although Tether’s foreign status may invite scrutiny.

Corporate stablecoins: With clarity, major players may fast-track launches—Amazon and Walmart previously had stablecoin pilots on hold.

Macro flows: Enhanced institutional confidence could drive growth in Treasuries (as reserve assets) and further crypto adoption across fintech and institutional corridors.

According to an X post from Treasury Secretary Scott Bessent: Recent reporting projects that stablecoins could grow into a $3.7 trillion market by the end of the decade. That scenario becomes more likely with passage of the GENIUS Act. A thriving stablecoin ecosystem will drive demand from the private sector for US Treasuries, which back stablecoins. This newfound demand could lower government borrowing costs and help rein in the national debt. It could also onramp millions of new users—across the globe—to the dollar-based digital asset economy. It’s a win-win-win for everyone involved.

Senate Set to Vote on GENIUS Act Today

The U.S. Senate is poised to vote today on the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, a landmark bill aiming to establish the first federal regulatory framework for stablecoins. The legislation has garnered bipartisan support, with 18 Democratic senators joining the Republican majority in backing the bill.

The GENIUS Act mandates that stablecoins be fully backed by reserves, including cash and treasuries, with regular audits to ensure transparency. It also includes provisions to prevent members of Congress and their families from profiting off stablecoins, though it notably excludes the President and his family—a point of contention among some

🏦 Implications for Traditional Banking

The potential passage of the GENIUS Act has significant implications for traditional banking institutions. Major retailers like Amazon and Walmart are exploring the introduction of stablecoins as a new payment method, which could reduce transaction fees and enhance efficiency in global payments. This move may diminish reliance on traditional funds transfer systems, potentially disrupting the traditional banking sector.

Furthermore, the legislation's support for stablecoins could accelerate the adoption of digital currencies, challenging banks' dominance in payments, lending, and custody services. Financial institutions may need to adapt quickly to this evolving landscape to remain competitive.

📈 Market Response

The crypto industry has responded positively to the anticipated passage of the GENIUS Act. Shares of Circle, the issuer of the USDC stablecoin, have surged since their IPO earlier this month, reflecting investor optimism about the company's position in a regulated stablecoin market.

🧭 Looking Ahead

If the Senate passes the GENIUS Act today, the bill will move to the Republican-controlled House of Representatives, where further amendments could be proposed. President Trump has expressed urgency in signing the bill before the August recess, signaling strong executive support for the legislation.

As the regulatory landscape for stablecoins evolves, stakeholders across the financial sector will need to monitor developments closely and prepare for the potential shifts in the market dynamics.

Retail Giants Step Into the Stablecoin Arena

📢 Walmart and Amazon Enter the Chat

In a landmark development for digital finance, Walmart and Amazon are reportedly exploring the launch of their own stablecoins. According to a recent article from Cointelegraph, both retail titans are examining how blockchain-based payment systems—specifically stablecoins—could streamline customer experiences, reduce transaction fees, and improve settlement times for online and in-store purchases.

This move echoes a broader trend: corporate-issued stablecoins are rapidly moving from concept to reality. While Meta's Diem may have struggled to launch due prior regulatory uncertainty, the business case for closed-loop stablecoins remains compelling—especially if deployed over fully-regulated stables within massive retail ecosystems where the issuers control both the infrastructure and user experience.

Key Advantages for Retailers:

Cost Reduction: Bypassing credit card networks means lower transaction fees.

Faster Settlement: Blockchain-based payments settle in seconds or minutes—not days.

Customer Loyalty Integration: Stablecoins can be linked to loyalty programs and incentives.

Data Control: Direct wallet-based payments reduce third-party data exposure.

This isn’t just tech experimentation—it’s a strategic pivot. With digital-native Gen Z consumers expecting instant, mobile-first payments, the retailers who lead in this space could redefine what it means to “check out.”

🧠 The Genius Act: Fueling the Next Wave?

If passed, the Genius Act—a proposed bill aimed at supporting blockchain innovation and responsible digital asset regulation—could significantly accelerate the adoption of stablecoins across industries. By offering clear federal guidelines, the Act would:

Provide regulatory clarity for USD-backed stablecoin issuers;

Establish consumer protection standards while avoiding overreach;

Allow non-financial companies, like Walmart and Amazon, to participate under a structured compliance regime.

This legal certainty is critical. Right now, the biggest bottleneck for retail-issued stablecoins isn’t technology—it’s the fog of regulatory uncertainty. The Genius Act could dispel that fog.

🔮 What's Next: Retail-Coin Ecosystems

We’re witnessing the formation of retail micro-economies. If Walmart or Amazon launches a stablecoin, it could:

Be interoperable with other retailers or e-commerce platforms;

Tokenize reward systems, making loyalty points tradeable;

Be usable beyond retail—think remittances, payroll advances, or even DeFi integrations in partnership with fintech apps.

And they won’t be alone. Expect Target, Costco, or even Uber to explore similar instruments, especially if early adopters demonstrate cost savings and customer stickiness.

🧭 What to Watch

Pilot Programs: Look out for closed trials in specific states or for specific customer cohorts.

Partnerships: Retailers may partner with fintech startups or layer-1 blockchains like Solana or Base to test deployment.

Congressional Movement on the Genius Act: Committee progress or public hearings will signal how soon regulatory clarity might arrive.

📬 Final Take

Walmart and Amazon entering the stablecoin space isn’t just a validation—it’s a paradigm shift. If the Genius Act becomes law, it will act as an accelerant, ushering in a new era where corporate stablecoins aren’t outliers but the norm. Legal advisors, fintech builders, and institutional investors should start preparing now—because the rails of retail are being rebuilt in real-time.

Circle’s IPO Marks a New Era for U.S. Stablecoin Adoption

It all begins with an idea.

On June 5, 2025, Circle Internet Group—the issuer of the USD Coin (USDC) stablecoin—made a landmark debut on the New York Stock Exchange under the ticker symbol CRCL. Priced at $31 per share, the IPO raised approximately $1.1 billion, valuing the company at around $6.9 Billion.

This event signifies a pivotal moment in the integration of digital currencies into the traditional financial system. Circle's successful public offering not only reflects investor confidence in the company's business model but also underscores the growing acceptance of stablecoins as legitimate financial instruments.

Implications for Stablecoin Adoption in the U.S.

Circle's IPO arrives at a time when the U.S. is actively shaping its regulatory framework for digital assets. The proposed Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act aims to provide clear guidelines for stablecoin issuance and operation. Circle's public listing positions it advantageously to comply with forthcoming regulations and to set industry standards for transparency and accountability.

Moreover, the IPO enhances Circle's visibility and credibility, potentially accelerating the adoption of USDC in various sectors, including e-commerce, remittances, and decentralized finance. As businesses and consumers seek faster and more efficient payment solutions, USDC's integration into mainstream financial services could become increasingly

Looking Ahead

Circle's transition to a publicly traded company marks a significant step toward the mainstreaming of stablecoins in the U.S. financial landscape. As regulatory clarity improves and institutional interest grows, stablecoins like USDC are poised to play a central role in the evolution of digital payments and financial inclusion.

Congressional Push for Clarity: Rep. Timmons Urges SEC to Produce Records on Ethereum's Legal Status

It all begins with an idea.

On June 10, 2025, Representative William Timmons (R-SC) sent a letter to SEC Chairman Paul Atkins, asking the SEC to release documents from the Gensler era regarding the regulatory status of Ethereum (ETH). This letter addresses the ongoing uncertainty surrounding whether ETH should be classified as a security or a commodity, a distinction that has significant implications for the cryptocurrency industry.

Disclosing these documents will help Congress, market participants, and the public betterunderstand how and why the SEC's position on ETH shifted under Chair Gensler. It will also bring transparency to the shadow "regulation by enforcement" approach that, for years under the prior Administration, hindered innovation and growth across the crypto industry.

Rep. Timmons expresses concern over the SEC's prior lack of clarity regarding the classification of ETH, emphasizing the need for definitive guidance to ensure regulatory consistency.

Implications for ETH's Classification

Rep. Timmons' letter underscores the pressing need for regulatory clarity in the cryptocurrency sector. This letter draws attention to the onging conflict between the SEC and the Commodity Futures Trading Commission (CFTC) regarding ETH. The CFTC has previously identified ETH as a commodity, while the SEC has not provided a clear stance.

The classification of ETH as either a security or a commodity determines which federal agency has jurisdiction over its regulation—the SEC or the CFTC. This distinction affects everything from compliance requirements for companies to the types of investment products that can be offered to consumers.

The SEC's current ambiguity has led to a fragmented regulatory environment, where companies are uncertain about the rules governing their operations. This uncertainty can stifle innovation, deter investment, and potentially drive blockchain development to more crypto-friendly jurisdictions.

By advocating for a clear and unified regulatory approach, Timmons aims to eliminate these ambiguities, providing a stable foundation for the growth of digital assets like ETH. Such clarity would not only benefit market participants but also enhance consumer protection and market integrity.

Rep. Timmons' initiative represents a significant step toward resolving one of the most contentious issues in cryptocurrency regulation. By directly addressing the SEC and calling for inter-agency collaboration, the letter highlights the urgency of establishing a clear regulatory framework for digital assets.

Bitcoin 2025: Legal Takeaways from Vegas

It all begins with an idea.

Las Vegas was buzzing for the Bitcoin 2025 Conference—and not just with price predictions. The energy was high, the conviction was real, and the regulatory tide has clearly begun to shift. As I walked the floors, spoke on panels, and soaked in the new legal infrastructure being built, one thing became clear: this cycle’s narrative isn’t just number go up—it’s law catching up.

Bitcoin 2025 Vegas marked a significant milestone in the mainstream acceptance of cryptocurrency, featuring a powerhouse lineup of speakers that underscored the growing political and institutional support for Bitcoin. Vice President JD Vance's keynote address highlighted the Trump administration's pro-crypto stance, signaling a shift towards embracing digital assets at the highest levels of government—and ending the prior administration’s war on crypto—including the debanking of crypto companies and users under Operation Choke Point 2.0. Vance emphasized that crypto finally has a champion and an ally in the White House, advocating for regulatory clarity and the integration of cryptocurrencies into the mainstream economy.

The conference also featured prominent figures such as Ross Ulbricht, Michael Saylor, Senator Cynthia Lummis, and Robinhood CEO Vlad Tenev, reflecting a diverse coalition of political leaders, industry pioneers, and financial innovators.

🔍 CLE Legal Track Highlights: Bitcoin and the Law Meet in Vegas

The Bitcoin 2025 CLE program was one of the strongest legal tracks I’ve seen at any crypto event. If you missed it, here’s what stood out from each session:

1. Bitcoin and Trump 2.0: The Strategic Bitcoin Reserve Era

Panelists broke down how the next administration could drive Bitcoin policy, including the bold Strategic Bitcoin Reserve (SBR) plan—essentially turning Bitcoin into a sovereign asset class. Props to to the panel for also breakdown of the DOJ’s Blanche Memo and the prior administration’s weaponization of the money transmitter statute to prosecute crypto code creators.

🔗 My take on this session

2. Bitcoin on the Balance Sheet: Corporate Treasury Strategies

This panel offered practical blueprints for how public companies can legally move Bitcoin, potentially other qualifying crypto assets, into their treasuries.

Key takeaways:

How to structure board resolutions.

How to navigate securities disclosure and FASB impairment.

And how to use PIPEs, convertible notes, and public offerings to fund a treasury build.

🔗 My summary here⚖️ Meeting Tor Ekeland: A Frontline Defender in Crypto’s Legal Battles

One of the most meaningful conversations I had at Bitcoin 2025 was with Tor Ekeland and his legal team. Tor’s name is well known to those of us in the crypto defense world for his fearless advocacy on behalf of clients targeted by expansive government theories in cybercrime and crypto prosecutions. At the center of our conversation was his tireless work defending Roman Sterlingov—the alleged operator of Bitcoin Fog—who was convicted earlier this year following a DOJ prosecution that hinged on dubious blockchain forensics and circumstantial digital evidence. That case is now pending on appeal.

Tor’s commitment to pushing back against prosecutorial overreach in the digital asset space is a reminder that while the law may be catching up to crypto innovation, it’s often adversarial cases like this that shape the boundaries of enforcement power.

Another highlight of the conference was meeting and visiting with Calli Bailey, one of the original founders of the Bitcoin Conference. We talked about her excitement over the continued growth of BTC Inc.'s flagship event—riding high off last year’s successful debut in Nashville and this year’s huge turnout in Las Vegas. Her vision for expanding the reach and impact of the conference was inspiring, as she emphasized how crucial it is to keep building community and momentum in the Bitcoin space. Big thanks to crypto tax lawyer, Kristin Stroud, for making the introduction.

Another major highlight was catching some powerhouse speakers who delivered sharp, forward-looking takes on the future of crypto and digital finance:

Arthur Hayes brought the heat, forecasting Bitcoin’s continued upward trajectory and making a compelling case for the massive upside in U.S. Treasuries if the GENIUS Stablecoin Act becomes law. His macro analysis didn’t disappoint.

SEC Commissioner Hester Peirce, known affectionately as Crypto Mom, weighed in on the much-needed regulatory reset happening at the SEC. Her remarks were a breath of fresh air for those hoping to see more thoughtful and tech-savvy policymaking in Washington.

On the Nakamoto Stage, Tether’s Paola Ardoino shared bold insights on the future of Tether, emphasizing growth, infrastructure expansion, and stability strategies in evolving markets.

These talks underscored the energy and momentum building around Bitcoin, stablecoins, and regulatory reform in the U.S.—with leaders who clearly see where the puck is headed.

🏦 New Trends: Public Companies Want BTC and ETH in Treasury

The breakout legal theme this year wasn’t regulatory overreach or criminal risk—it was capital strategy. Companies are now actively structuring takeovers and convertible offerings to add BTC and ETH to balance sheets. Think Saylor 2.0, but across dozens of microcaps and SPACs.

The Janover case study shared during CLE (Session 2) showed exactly how a company can:

Acquire a controlling interest in a PubCo,

Change treasury policy,

And fund it all with equity + debt raises.

Adding to the momentum around digital asset treasuries, a recent headline-grabbing transaction suggests that corporate interest in Ethereum (ETH) is accelerating. In May 2025, SharpLink Gaming (NASDAQ: SBET), a small-cap online gaming company, announced a $425 million private investment in public equity (PIPE) to make ETH its primary treasury reserve asset. The deal, executed under Section 4(a)(2) and Regulation D, saw the issuance of roughly 69.1 million new shares to accredited investors, including Consensys Software Inc. (founded by Ethereum co-founder Joseph Lubin), Pantera Capital, and Galaxy Digital. The market’s response was immediate—SBET’s stock price soared over 1,000% in just one week.

🇺🇸 Future Trends: GENIUS Act—Stablecoin Regulation Is Coming

In conversations with regulatory attorneys and colleagues throughout the event, it was clear: the GENIUS Act, if passed , wil be the biggest non-crypto native digital asset onboarding multiplier ever. The bill, if signed into law, will create a federally regulated, bank-grade framework for USD-backed stablecoins.

Here’s my core thesis, shaped by dozens of conversations with lawyers, founders, and executives in Vegas: The GENIUS Act will be the single biggest non-crypto-native onboarding moment of the cycle.

Why?

Stablecoins fix wires. No more waiting days, worrying about reversals, or facing absurd SWIFT fees.

Dollar exposure, without bank risk. Businesses can move millions with stablecoins faster than a bank can send a confirmation.

Family offices, e-commerce shops, and cross-border trade platforms are next.They don’t care about ideology—they care about settlement speed and cost.

🎙️ Final Word from the Floor

I left Bitcoin 2025 more confident than ever that we’re heading into a regulatory environment where crypto isn’t just tolerated—it’s leveraged. Builders aren’t hiding anymore. Lawyers aren’t just saying “no.” And Congress is finally drafting laws instead of letting agencies stretch 1940s rules into 21st-century tech.

Whether you’re advising clients, launching a startup, or structuring a treasury—this is the time to lean in.

From Paper to Protocol: How Stablecoins Streamline Global Invoicing

It all begins with an idea.

If your business sends or receives invoices across borders, you’ve likely felt the pain:

• Wire transfer delays

• Compliance holds

• Exchange rate losses

• Hidden fees

Stablecoins fix this.

Instead of waiting days for payment to clear, businesses are now settling cross-border invoices in minutes using stablecoins like USDC. No middlemen. No currency conversion drama. Just fast, secure, and transparent payments—at a fraction of the cost.

Real-World Example:

A logistics firm in Texas pays Latin American vendors in USDC. What once took 3-5 days now takes under 60 seconds—with full auditability and near-zero transaction fees.

And with the GENIUS Act likely to provide federal guardrails for stablecoin use in commerce, this isn’t just possible—it’s becoming inevitable.

If your business invoices across borders, stablecoins are the upgrade you didn’t know you needed. With proper setup and legal guidance, you can leverage stables to streamline your payment processing and improve your company’s bottom line.